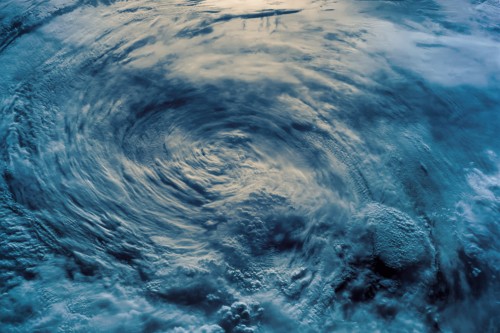

Storms can occur anywhere in the Northern Territory and while they can be a majestic sight to behold when you’re in a safe place, they can be scary if you’re caught driving in one.

We’ve listed 10 tips to help stay safe driving in storms:

Firstly, avoid driving in severe weather where possible.

If you are caught in a storm, pull over to the side of the road when it is safe to do so.

If you are driving through a storm and have nowhere safe to pull over, turn on your headlights so you are visible to other drivers.

Be aware that it can take longer to brake when driving in the wet, so leave a safe distance (approximately five seconds) between your car and other vehicles.

Take the advice of the Northern Territory Emergency Service (NTES) and never enter or drive through floodwater.

Monitor for changes in weather and have alternatives routes or plans in place.

Make sure your car is serviced and safe to drive, including working windscreen wipers and lights, as well as regularly checking your tyre pressure and tread, particularly during wet season.

Make a family emergency kit, with items you might need during a flood, storm or another emergency, and ensure it travels with you.

If a storm is approaching park your car under cover or away from trees.

Make sure your car insurance is up to date. With Comprehensive car Insurance through AANT, your vehicle is covered for loss or damage as a result of storm or flood*.

If you have any questions relating to car insurance, contact our team on 08 8925 5901 or for a quote click here.

*Underwriting criteria, policy terms, conditions, limits and exclusions apply. Please see the PDS for full details.

Important information:

This insurance product is distributed by Automobile Association of Northern Territory Inc ABN 13 431 478 529, an authorised representative of the issuer Insurance Australia Limited trading as CGU Insurance ABN 11 000 016 722, AFSL 227681. Any advice provided is general advice only and does not take into account your individual objectives, financial situation or needs (“your personal circumstances”). Before using this advice to decide whether to purchase a product, you should consider your personal circumstances and the relevant Product Disclosure Statement and Target Market Determinations from www.aant.com.au